How Offshore Trusts Help with Estate Planning Across Borders

How Offshore Trusts Help with Estate Planning Across Borders

Blog Article

Why You Ought To Consider an Offshore Depend On for Safeguarding Your Assets and Future Generations

If you're looking to protect your wide range and ensure it lasts for future generations, thinking about an overseas trust fund may be a smart move. As you check out the potential of overseas counts on, you'll discover exactly how they can be customized to fit your details requirements and goals.

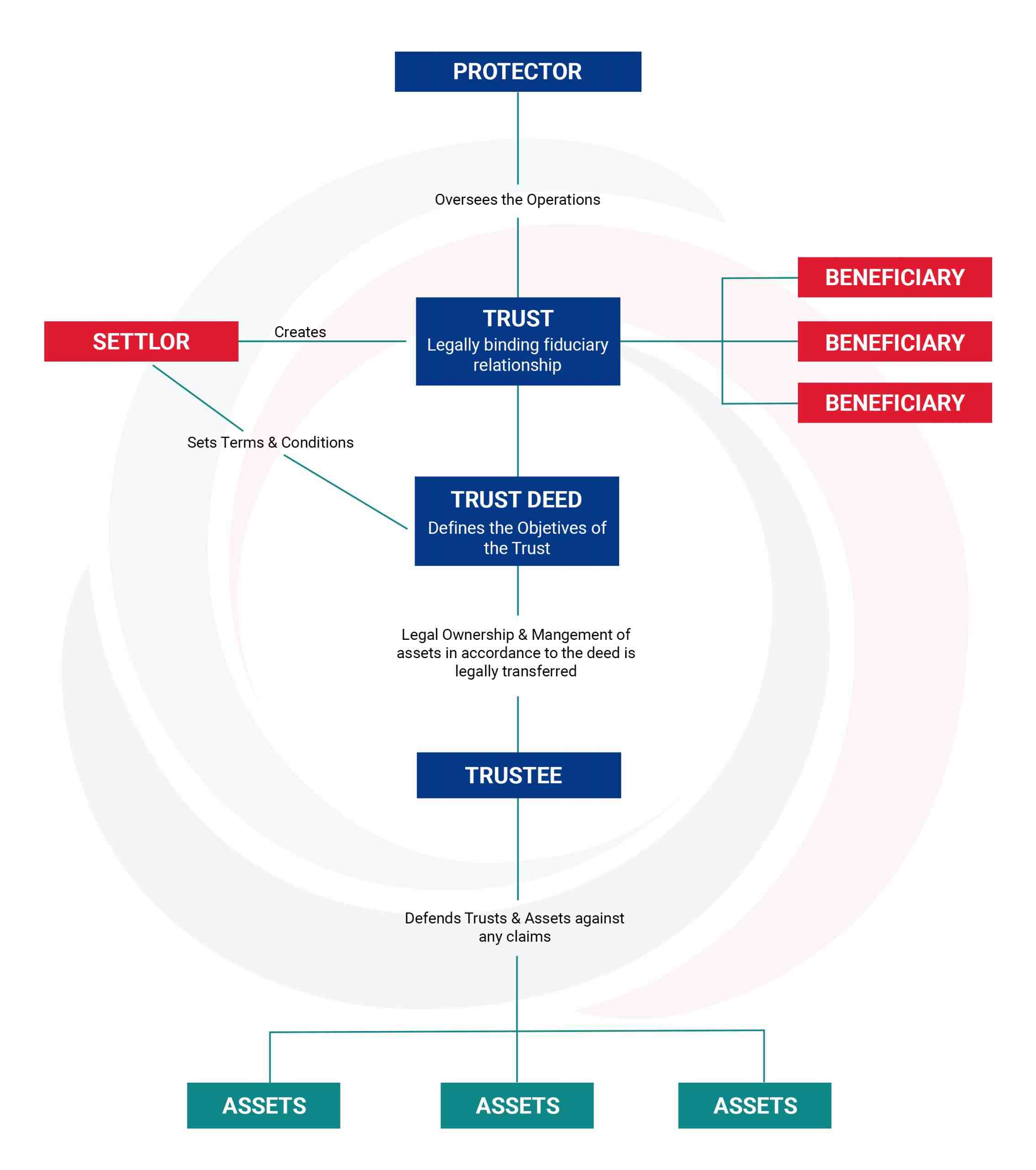

Recognizing Offshore Trust Funds: What They Are and Exactly How They Function

When you think concerning securing your properties, offshore trusts might come to mind as a viable alternative. An offshore count on is a legal setup where you transfer your properties to a trustee located in one more nation.

The secret parts of an offshore trust fund consist of the settlor (you), the trustee, and the beneficiaries. Recognizing exactly how offshore trusts feature is vital before you make a decision whether they're the ideal choice for your property protection method.

Advantages of Establishing an Offshore Count On

Why should you consider establishing an offshore trust? In addition, overseas counts on use adaptability relating to property administration (Offshore Trusts).

An additional secret advantage is personal privacy. Offshore counts on can offer a higher degree of confidentiality, shielding your financial affairs from public examination. This can be important for those desiring to maintain their wide range discreet. Establishing an offshore count on can promote generational wide range conservation. It enables you to set terms for just how your properties are distributed, ensuring they benefit your future generations. Inevitably, an offshore trust fund can work as a tactical device for protecting your economic tradition.

Safeguarding Your Assets From Lawful Claims and Lenders

Establishing an overseas depend on not only supplies tax obligation benefits and personal privacy however also serves as a powerful guard against lawful insurance claims and creditors. When you position your possessions in an offshore trust, they're no longer thought about component of your personal estate, making it a lot harder for lenders to access them. This splitting up can safeguard your wide range from claims and claims developing from service conflicts or personal obligations.

With the right jurisdiction, your possessions can gain from rigorous privacy regulations that hinder creditors from seeking your riches. In addition, many overseas depends on are designed to be challenging to pass through, often requiring court action in the trust's jurisdiction, which can act as a deterrent.

Tax Effectiveness: Decreasing Tax Obligation Obligations With Offshore Trust Funds

Additionally, because counts on are commonly strained differently than individuals, you can benefit from reduced tax obligation prices. It's crucial, nonetheless, to structure your trust fund effectively to ensure compliance with both domestic and international tax obligation regulations. Dealing with a professional tax obligation expert can aid you browse these intricacies.

Guaranteeing Privacy and Confidentiality for Your Wealth

When it comes to protecting your wide range, ensuring privacy and discretion is necessary in today's significantly transparent economic landscape. An overseas trust can supply a layer of security that's tough to achieve through residential options. By placing your properties in an offshore territory, you protect your financial details from public examination and reduce the threat of unwanted focus.

These depends on typically come with rigorous privacy regulations that avoid unauthorized accessibility to your monetary details. This suggests you can secure your wealth while maintaining your comfort. You'll also restrict the possibility of legal disputes, as the information of your trust continue to be private.

Moreover, having an overseas count on means your possessions are much less a fantastic read prone to individual liability insurance claims or unexpected monetary situations. It's a proactive step you can require to guarantee your monetary heritage continues to be intact and exclusive for future generations. Count on an overseas framework to protect your riches effectively.

Control Over Property Distribution and Administration

Control over asset circulation and monitoring is just one of the crucial advantages of setting up an overseas depend on. By establishing this depend on, you can dictate exactly how and when your assets are dispersed to beneficiaries. You're not just handing over your riches; you're establishing terms that mirror your vision for your heritage.

You can develop details conditions for distributions, guaranteeing that beneficiaries meet certain criteria before receiving their share. This control helps protect against mismanagement and guarantees your properties are utilized in methods you consider proper.

In addition, appointing a trustee allows you to pass on monitoring responsibilities while retaining oversight. You can choose a person that straightens with your worths and comprehends your goals, guaranteeing your assets are taken care of intelligently.

With an overseas trust fund, you're not just securing your riches however likewise forming the future of your recipients, providing them with the assistance they require while maintaining your desired level of control.

Selecting the Right Jurisdiction for Your Offshore Depend On

Look for nations with solid legal structures that support count on legislations, making certain that your possessions continue to be safe from prospective future cases. Furthermore, ease of access to neighborhood monetary establishments and knowledgeable trustees can make a big difference in handling more helpful hints your trust successfully.

It's important to assess the expenses entailed also; some territories might have greater arrangement pop over to this web-site or maintenance fees. Eventually, selecting the ideal territory means aligning your financial objectives and family needs with the specific advantages supplied by that place - Offshore Trusts. Take your time to research and talk to professionals to make one of the most enlightened choice

Regularly Asked Questions

What Are the Costs Related To Establishing an Offshore Count On?

Establishing an offshore count on includes different expenses, consisting of lawful charges, configuration fees, and recurring maintenance costs. You'll intend to allocate these aspects to assure your count on operates effectively and successfully.

Exactly How Can I Discover a Trusted Offshore Depend On Provider?

To find a credible overseas trust copyright, study online reviews, ask for recommendations, and confirm credentials. Ensure they're skilled and transparent concerning costs, solutions, and guidelines. Depend on your impulses during the selection process.

Can I Handle My Offshore Trust Fund From Another Location?

Yes, you can manage your overseas depend on remotely. Several carriers supply on the internet access, permitting you to check investments, communicate with trustees, and accessibility papers from anywhere. Just assure you have safe and secure net access to protect your details.

What Takes place if I Relocate to a Different Country?

If you relocate to a various nation, your offshore trust's laws may alter. You'll need to talk to your trustee and potentially change your trust fund's terms to adhere to neighborhood laws and tax obligation effects.

Are Offshore Trusts Legal for People of All Nations?

Yes, offshore depends on are legal for people of several countries, but guidelines vary. It's vital to investigate your nation's regulations and get in touch with a lawful expert to assure conformity and understand potential tax obligation effects prior to continuing.

Report this page